Guides

Guide for Buying Your Next Home

How to Buy a New Home: Ottawa

The Ultimate Buyers Guide for your Next Home

Research &

planning

As an existing homeowner, you’ve already been on the home buying journey. But now you’re getting ready to purchase again, maybe because your family is growing or you’re ready for a home with workspace or you’re preparing to downsize. Whatever your reason, you’ll find the market and the buying process may have changed.

That’s why we’ve created the Ultimate Home Buyer’s Guide for Your Next Home.

So, welcome aboard. We think you’ll find our road map to buying a house informative and fun.

Your finances

Whether you are upsizing or downsizing, buying a new house means starting with the question, “What is my budget?” Personal circumstances dictate the answer, but you might be surprised at how affordable a new home is when you have equity built into your existing one. Despite the advantage equity gives you, however, you still have to start by getting your finances in good order.

How much home can you afford?

The first thing you need to do in the process of buying a house is to calculate how much you can plan to budget for.

Start by realizing that, depending on the value of your current home and the one you are buying, you could be taking on a new mortgage. That’s especially the case if the equity in your home and your savings don’t equal the purchase price of your new home. To get a clearer sense of exactly where you stand, add up your savings and find out how much equity you have in your current home.

You also need to know a couple of things about mortgages:

- The one-third rule: It’s an old one but still applies. Total up the expected monthly mortgage payment, property tax and heating costs for your next home. If they don’t exceed about one-third of your taxable income, then you’re likely ready to buy. If you’re condo shopping, add 50% of your monthly condo fees to your mortgage, tax and heating costs.

- Total debt service ratio: Another affordability formula. Total your anticipated monthly payments on the mortgage, property taxes, heating and all other debts, including payments on your credit card and car loan. If the total isn’t more than 40 per cent of your taxable monthly income, you’re in good financial shape.

You may have enough equity in your existing home to cover the down payment on your new home, but don’t take a chance: confirm it first.

More financial considerations

- The equity you have in your existing home may cover the down payment on your new home. However, you need to confirm this with your bank and builder. If you don’t have sufficient funds for the down payment, you can wait a little longer before buying to save the extra money or choose a less expensive home requiring a smaller down payment. You should also speak to your lender about other possible solutions.

- There are advantages to buying a new-build home, including not having potentially hefty renovation or repair expenses as you would with a resale home. What’s more, a well-built new home is very energy efficient, so you have lower energy costs. Despite that, if you’re trading up to a bigger house, you will have bigger expenses, including property taxes.

- A new home also needs routine maintenance like servicing your heating and cooling system. Annual maintenance costs are about one per cent of your home’s value, although it’s usually less for new homes and more for resale ones.

- You want to have enough money left at the end of each month for what’s really important to you: family activities, whether that’s a night out with the kids or a vacation at the beach

- You’ll also want to continue putting aside money in a rainy day fund, for your children’s education if they haven’t yet finished school and, if you’re still working, for retirement.

- Finally, ask yourself if your current home is in tip-top shape to go on the market? How much will it cost for the repairs, renovations and staging needed to get top dollar when you sell? Preparing a rough budget that incorporates all of these factors will help you calculate how much home you can afford. Use an affordability calculator and handy tools such as the Real Life Ratio calculator to help you.

Other costs, rebates & incentives

When calculating the cost of buying a home, you need to assess more than just mortgage and other regular payments. Fortunately, you may be able to access some government incentives and rebates.

Up-front expenses when buying a home

Deposits: When you buy your home, you’ll have to make an initial deposit as well. You’ll also need to make interim payments, according to a schedule, before you take possession. With Minto Communities, for example, a minimum $5,000 to $10,000 deposit at signing is required and additional interim payments thereafter; the exact amounts depend on the type of house you decide to buy.

Additional Investments: The finishes in a new home offer plenty of variety, but you still usually have the option of choosing different layouts and upgrading finishes like countertops, cabinetry and flooring. These are a great way to incorporate a designer’s touch and to personalize your space. The investments can even potentially enhance resale value.

Your builder likely has an in-house design team that can help you create a package of additional investments to satisfy your tastes and your budget.

Closing costs: These are paid before or at the time of closing. In general, they amount to 1.5 to 2% of the purchase price, although that varies.

Additional investments or upgrades in your home let you add a designer’s touch that fits your personality.

Common closing costs

- Land transfer tax: This is based on a percentage of your purchase price. Calculate it here.

- Legal fees and disbursements: They are part of hiring a good real estate lawyer. They vary, but legal fees for buying a house run around $1,500.

- GST/HST: If your home is your primary residence, the HST is part of the selling price for your home. You will only pay HST as a closing cost if the home you are buying is for investment purposes.

- New Home Enrolment Fee: There are two regulatory bodies included in the enrolment process – (1) Tarion, a not-for-profit consumer protection organization who provides homeowners with warranty coverage, and (2) Home Construction Regulatory Authority (HCRA) who licenses the people and companies who build and sell new homes in Ontario. Both fees are collected by Tarion and rates depend on the value of your home, check their websites for current fees.

Other possible costs

- There may be bank fees tied to your mortgage.

- If you are making a down payment that’s less than 20% of the purchase price, you’ll need to have mortgage loan insurance. It’s available through Canada Mortgage and Housing Corporation (CMHC) and other approved institutions. The cost depends on the price of your home, and the premiums can be paid upfront as a lump sum or blended into your regular mortgage payments.

Tip: Are funds tight for your new home purchase? Then consider building the cost of additional investments into your mortgage — another reason for knowing exactly how much home you can actually afford

- You’ll need to purchase insurance on your home and property. The amount depends on multiple factors, including the value of your home.

- If buying a resale home, you should definitely have it inspected; that usually costs around $400.

- Unless you’re eager to return to your DIY student days, you’ll likely want to hire a mover. If there’s a delay between moving out of your existing home and into your new one, you may also need to pay for storage (and a place to live). Fees for these services vary, depending on how far you’re moving and how much storage space you need. Your best bet is to get a rough quote from a reputable moving company for both services.

- Make sure you’ve set aside some money for set up costs such as Internet, telephone, gas, electrical, water, etc.

- You may also need to spend money on eavestrough, fencing, landscaping, blinds and curtains, appliances and other necessities.

New Home Buyers’ Financial Assistance Programs

The amounts and conditions below are correct at the time of publishing, but you should confirm them when you are getting ready to buy.

Government of Canada

- If you are a person with a disability who is buying or building a home for yourself, or if you are helping a related person with a disability buy or build a qualifying home, the Home Buyers’ Plan (HBP) lets you withdraw up to $35,000 from your Registered Retirement Savings Plan (RRSP) to use for the purchase. You have to repay it within 15 years to avoid being taxed on the withdrawal.

- Homes that are certified under specific energy programs are eligible to receive a partial premium refund on CMHC’s mortgage loan insurance. A similar program is offered by Genworth Canada.

Government of Ontario

Low- to moderate-income Ontario residents can get assistance through the Ontario energy and property tax credit for sales tax on energy and for property taxes.

Get your budget into final form

You started with a rough budget for home buying. Now you should fine-tune it, incorporating the extra costs and financial assistance you’ve discovered. Use the worksheet from the Financial Consumer Agency of Canada to help identify the costs of home buying and maintenance. Once you’ve put all the numbers together, you’re well-positioned to start making more informed buying decisions.

Note: Government assistance programs, including benefits and regulations, change. Doing an online search and speaking to your builder’s Sales Representative when you’re ready to buy will help keep you up to date on what’s available.

How you live & what you need

Why do you want to buy a new home? There’s no one answer to the question — some people buy because they need more space, others because they want less; some buy to be closer to family and friends; some because it’s time for a fresh start or they are looking at a long-term investment.

In other words, the reasons you shop for a new home are as individual as you.

Even so, before signing on the dotted line, think over carefully why you want a new home and talk about it with people you trust.

Finally, ask yourself whether this is the best time to buy a house. Is the type of home you want available in the community you want?

Assess your housing needs and lifestyle

The experience of buying a home has an emotional element. Being a buyer and an owner should be fun, rewarding and motivate you and your family to live out your dreams and be part of your new community. But the buying decision has to be rational as well, based on figuring out your family’s desires, limitations and possible longer-term needs.

To help ensure your decision is logical, think about these questions:

- When do you hope to move into your new home? A lapse of 12 to 18 months between signing an Agreement of Purchase and Sale and moving into the house is typical.

- What is your lifestyle, and what do you imagine it looking like in 5 or 10 years? If you’re downsizing, two bedrooms may be enough most of the time, but will it be if you have grandchildren visiting for extended periods in a few years’ time?

- What kind of homeowner are you? Does the idea of a lot of space get you excited about the possibilities? If not, maybe a low-maintenance condo or townhouse is a more appealing lifestyle for your needs. Learn more about buying a condo versus buying a freehold home

- What is working and not working for you in your current home? Size? Layout? Closet and storage space? Proximity to amenities like parks and shopping? Keep an eye out for these things when you are shopping for a new home. It’s a good idea to make a list of the things you love about your current home and the things you want to change. Maybe you need more or different space for entertaining, or a larger foyer for receiving guests, or a different balance of private vs. open family space. Keep in mind that moving up in house size, say from a town to a single, may be an upgrade in general but isn’t a guarantee that the new home will have all the features of your old one.

- Are you looking for a new or resale home? Buying new has many advantages, from the high quality of today’s construction methods and having a warranty to the opportunity to contribute to a fresh, growing community.

- What sort of neighbourhood suits you — the bustling downtown core or a suburban community where you’ll need to commute but you’ll enjoy all the benefits of quiet surroundings, lots of green space, new schools and the like?

- Have you taken the time to really explore the homes and communities available when you’re buying a house in Ottawa? This website has pooled extensive information on builders, housing developments, model homes and more, saving you hours of research.

All this takes time and effort — maybe more than you realized — but you’ll be glad you invested both when you are settled into the home of your dreams.

Building your team

Good, professional financial, legal and other services are a crucial part of your home buying journey. Here’s what to expect.

Bank mortgage specialist or mortgage broker?

Whether your current mortgage was arranged directly with a bank or through a mortgage broker, start by speaking with them about borrowing options for your new home.

Uncertain about the difference between a traditional mortgage specialist and a mortgage broker?

- A mortgage specialist at a bank represents only that institution. Because interest rates and conditions as well as quality of service can vary from lender to lender, talk to several to get the deal that best suits you.

- Unlike a traditional banker, a mortgage broker can access multiple lenders and possibly get a better interest rate and/or terms for you. A mortgage broker approval and rate are usually valid within the time frame of 120 days to closing, so if you are purchasing a home and the closing date is more than 120 days away, you may have to re-qualify through this process (more than once) and your rate may be subject to change.

Whether you use a bank or a mortgage broker, being comfortable with both the person and the products is essential. Make sure you have compared mortgage rates to other institutions, using our mortgage calculator to compare costs. It’s also critical that you fully understand your mortgage contract and ask questions; if the deal doesn’t fit your needs, walk away.

A golden rule for home buyers: get your mortgage pre-approved.

Building your team

Make sure you are pre-approved for a mortgage before you start shopping. It’s the only way to know exactly how much money you have to spend. That’s why pre-approval is considered a golden rule of home buying. Remember that while it doesn’t guarantee you will get the funds, it is a pretty good assurance. Just make sure that the terms and conditions you’ve negotiated are all included in your pre-approval agreement. Learn about mortgage pre-approval.

Financing options

Speak with your current lender and other financial institutions on your financing options. You may be able to borrow money against the equity of your current house to purchase your next home.

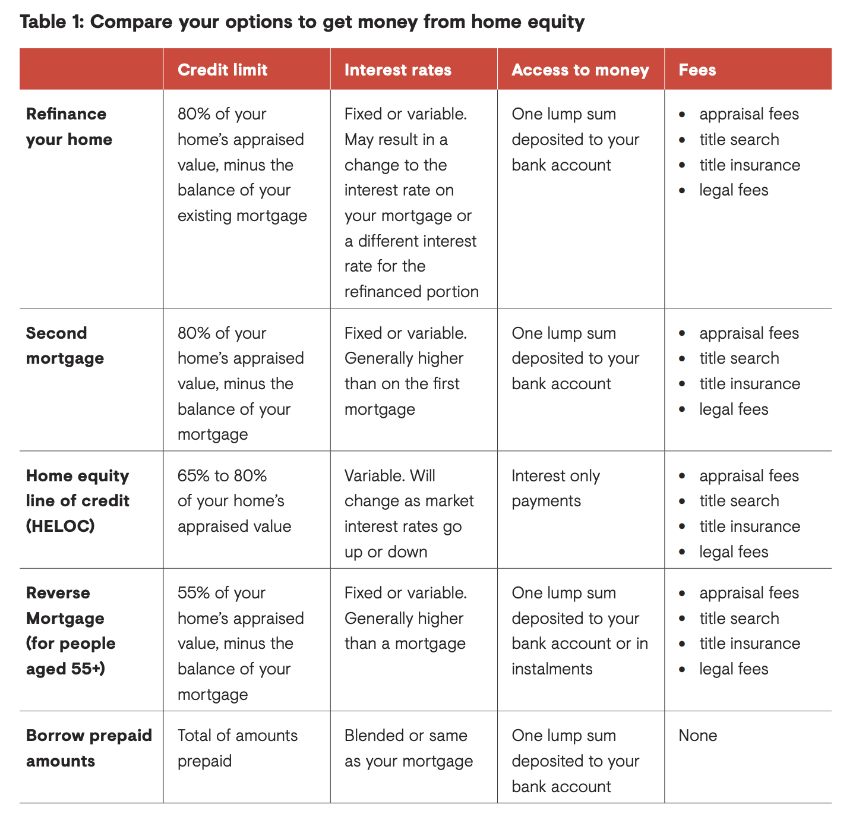

Table 1 on the following page demonstrates different loan scenarios from Financial Consumer Agency of Canada to get money from home equity.

Helpful Links

Source: https://www.canada.ca/en/financial-consumer-agency/services/mortgages/borrow-home-equity.html

Legal support

It’s wise to line up a real estate lawyer early so you have someone able to review the Agreement of Purchase and Sale. When choosing a lawyer, home buyers often opt for a personal recommendation from a friend or family member. If that fails, try a Google search for real estate lawyers in Ottawa.

Make sure you ask any prospective lawyer about his or her experience with the kind of transaction you are undertaking. Someone familiar with the community and builder you’re considering may also be helpful.

More legal tips:

- Do you have a will? Ask a lawyer about having one prepared. The more you own, the more important these documents become. Don’t forget about assigning a power of attorney too

- If you are buying a home as an investment property, consult our Ultimate Guide to Becoming a Real Estate Investor.

- Discover more about hiring a lawyer when you are buying a house.

Realtors

“Do I need a realtor when buying a house?” is a common question when you’re shopping for a new home.

As a homeowner, selling your current house may be part of the process of buying a new house. While there are DIY options like Grapevine and Purple Bricks for selling your home, many people find it more efficient to hire a Realtor who knows the market and the ins and outs of real estate. One of the best ways of hiring a Realtor is to ask for recommendations from friends and family. More on choosing the right real estate agent.

If you’re thinking about buying a resale home, a real estate agent is the way to go. A good Realtor will guide you through the entire buying process, from research to negotiating the contract.

With a new-construction home, there is really no need for a Realtor. Most builders have their own Sales Representatives, and these people know their products and communities from top to bottom. Yes, they represent the builder, but their training and experience mean they are there to help you find the home you and your family want. They are your best resource when buying a new home.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

7 financial to-dos when buying a house

7 financial to-dos when buying a house Minto Communities mortgage payment calculator

Minto Communities mortgage payment calculator Debt Service Calculator

Debt Service Calculator What is bridge financing?

What is bridge financing?