Guides

First Time Home Buyers Guide

How to Buy a New Home: Ottawa

The Ultimate Buyers Guide for First-Timers

Research &

planning

Buying a home is an exciting — if daunting — prospect for any first-timer. That’s why we’ve created this guide. It will help answer the many questions you already have, as well as all of the ones you haven’t thought to ask yet.

Here's a quick video summary of what you need when buying your first home:

And if you're looking for a more in depth guide, our Ultimate Home Buyer’s Guide for First-Timers is just that — a complete look at what you need to know if you’re thinking of buying a house for the first time.

Money talk

When buying a house, it starts with the money.

The question on the lips of virtually every first-time home buyer is, “Does it fit within my budget?” The answer depends on your personal circumstances, but a home may be a lot more affordable than you imagine.

And keep in mind that while you may not be able to buy everything you want in a home right now, real estate can be excellent investment — first time buyers often take advantage of the growing equity in their first property when moving up to their next home

But before going house shopping for your first home, you’ll need to understand your financial situation.

What can you afford?

Deciding on your new home budget is your first step in the process of buying a house.

Two things to remember:

-

The old one-third rule about affordability still applies: in most cases, your monthly mortgage, property tax and heating costs shouldn’t exceed about one third of your taxable income or 35%. If you’re considering a condo, include 50% of your monthly condo fees along with your mortgage, property tax and heating costs. (Figure 1)

-

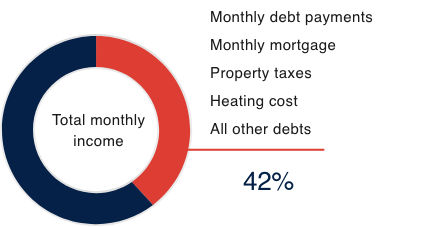

Another way of calculating affordability is the total debt service ratio. It sounds intimidating, but all it means is adding up the total of your monthly debt payments including mortgage, property taxes, heating and all other debts, including student loans and credit card payments. As long as that total doesn’t exceed about 42% of your taxable monthly income, you are in good shape. (Figure 2) Stay updated with current GDS and TDS ratios with the Canadian Mortgage and Housing Corporation’s debt calculator.

But there’s more to know.

Making a budget

It’s true that with a new construction home, you won’t be spending money on renovations or repairs as you would with a resale home, and energy costs are typically lower because a new home is designed and constructed to current building code requirements or even beyond.

However, even with a new-build home you still need to factor in realities like:

- Paying for household operating costs, from heating and cooling to property, water and other taxes.

- Covering routine maintenance, whether that’s servicing your furnace or hiring someone to clean your gutters. Maintenance costs run about one per cent of your home’s value annually, although the amount is usually less for new homes and more for resale properties

- Buying food and clothing, paying for transportation, and enjoying the occasional night out or vacation (even homeowners need to keep a healthy work-life balance!).

- Setting aside money for a rainy day fund and for retirement, even if retirement feels impossibly far off.

- Raising children, if they are in your plans, including saving for their education

Creating a preliminary budget that includes your income and current savings as well as your projected housing and non-housing expenses will give you a sense of what you can afford. An affordability calculator and specialized tools like the Real Life Ratio calculator help you determine how much mortgage you can actually afford.

Determining your down payment

What is the minimum down payment on a house?

In Canada, it is 5% of the purchase price. But for any down payment of less than 20%, you’ll have to pay mortgage insurance premiums to an organization like Canada Mortgage and Housing Corporation (CMHC).

If your down payment is 20% or more, there is no need to pay mortgage insurance.

Builders often require deposits upon signing that can be more than the down payment you want to make. That means you may have to save or borrow the money for the deposits, which can be put towards your down payment on closing.

If you have enough for the down payment, skip to More Money Matters. If you don’t, don’t despair. There are great benefits to home ownership, and a bit of creative thinking and patience can help you come up with that down payment:

- Do you have a family member willing to help you with your purchase by gifting you enough money to make up the shortfall on your down payment?

- Are you willing to look at a slightly smaller, more affordable home that requires a smaller down payment?

- Can you put off purchasing until you’ve saved a bit more? It’s amazing how fast your savings account grows if you reduce some discretionary spending like restaurant meals and driving to work.

If you don’t have quite enough for your down payment,don’t despair. Patience, creative thinking and our Sales Representatives’ experience with money matters will get you there.

Keep in mind: In Canada, there’s no such thing as buying a house without a down payment. A down payment is a key part of the process of buying a house, and the bigger your down payment, the smaller your mortgage premiums.

Down payment gift

Lenders will generally accept a gift from family as an acceptable part of a down payment. However, they usually want a letter from your benefactor stating that the money is a gift, not a loan that requires repayment.

More Money Matters

The cost of buying a home involves more than just a down payment, deposit and mortgage premiums. Fortunately, buying a house for the first time also means you could qualify for government incentives and rebates.

Builders often require deposits upon signing that can be more than the down payment you want to make. That means you may have to save or borrow the money for the deposits, which can be put towards your down payment on closing.

Additional up-front costs when buying a home

Deposits

When buying your first home, a deposit is typically required, which can be paid over several scheduled interim payments before taking possession. Minto Communities buyers, for example, make a minimum deposit of $5,000 at signing followed by interim payments of at least $5,000 each depending on the type of home purchased.

Additional investments

While most finishes included in a new home offer lots of variety, there is often the option to choose alternate layouts and upgrade finishes, including cabinetry, countertops and flooring. These can be a great way to add a designer’s touch to your new home, personalize your space and even potentially enhance resale value. They are an additional investment in your new home and are best decided on at the pre-construction stage to avoid costly — or even impossible — changes later on.

The cost of these investments varies widely depending on what you are doing. Your Sales Representative and your builder’s in-house design team can help you create a package that’s within your budget.

If available funds are tight, you could include the cost of additional investments in your mortgage: one more reason to know exactly how much home you can realistically afford.

Optional selections, sometimes called upgrades, are a great way to add a designer’s touch and personalize the space you are going to call home.

Closing costs

These are costs that have to be paid at the time of closing. They generally run between 1.5 to 2% of the purchase price, but that can vary. First-time buyers are sometimes unaware of these expenses, which need to be budgeted for. Your lawyer or financial advisor are the best resources for specific figures, but here are a few factors to consider.

Typical closing costs

Land transfer tax: This is calculated as a percentage of your purchase price. Calculate it here. See below for rebates on land transfer tax for first-time buyers.

Legal fees and disbursements: A good real estate lawyer is an indispensable part of home buying. Legal fees for buying a house vary, but you should expect to pay around $1,500.

GST/HST: If your home is your primary residence, the HST is part of the selling price for your home. You will only pay HST as a closing cost if the home you are buying is for investment purposes.

New Home Enrolment Fee: There are two regulatory bodies included in the enrolment process – (1) Tarion, a not-for-profit consumer protection organization who provides homeowners with warranty coverage, and (2) Home Construction Regulatory Authority (HCRA) who licenses the people and companies who build and sell new homes in Ontario. Both fees are collected by Tarion and rates depend on the value of your home, check their websites for current fees.

Other Costs:

There may be other fees. For instance:

- There could be bank fees associated with your mortgage.

- If your down payment is less than 20% of the purchase price, you’ll need to buy mortgage loan insurance. The insurance is provided by Canada Mortgage and Housing Corporation (CMHC) and other approved institutions. The cost is dependent on the price of your home, and you can pay the premiums up front as a lump sum or blend them into your mortgage payments. Home and property insurance is another necessity. The value of your home and other factors will determine the cost.

- If you are buying a resale home, you should have it inspected, at a cost of around $400.

- You should set aside a few hundred dollars to pay for electrical, internet and other hook-up fees.

- Depending on what kind of home you buy and what you already own, you may need to spend money on a lawn mower, eavestrough, appliances, air conditioning, blinds and curtains, fencing, landscaping, and other necessities

Slash moving costs

Moving costs vary depending on how much you have and how far you are going. Because they often don’t have a lot of possessions, first-time buyers frequently rent a cube van, recruit friends and family, invest in some beer, soft drinks and pizza, and do it themselves. Here are some ideas on moving yourself safely and economically

Incentives & rebates

There are various assistance programs for first-time new home buyers. While the amounts and terms below are correct at the time of publishing, they can change. Confirm them as part of your home purchase process:

Federal government

- The Home Buyers’ Plan outlines the amount you’re eligible to withdraw from your RRSP to put toward your home purchase. The first two years exclude repayment and then the 15-year amortization payback period begins.

- The First-Time Home Buyers’ tax credit, a $5,000 non-refundable income tax credit. Also see First-Time Home Buyer Incentive.

- Homes certified under specific energy programs are eligible for a partial premium refund on CMHC mortgage loan insurance. Genworth Canada offers a similar program.

Ontario government assistance

- Ontario offers a land transfer tax rebate to first-time buyers, on up to $368,333 of the full purchase price. The land transfer tax is paid at closing (see below).

- The Ontario energy and property tax credit assists all low- to moderate-income Ontario residents with the sales tax on energy and with property taxes.

Tip: Do a Google search when you are buying in case other programs have been introduced or benefit amounts and regulations have changed.

Finalize the budget

Remember the rough budget you started with? Now it’s time to go back and fine-tune it with all the extra costs and financial assistance you know will be coming your way. A worksheet from the Financial Consumer Agency of Canada can help you identify the costs involved in buying and maintaining a home. Once you’ve done all the math, you’re in a good position to start making informed decisions on home buying

Understanding your lifestyle and needs

We all know that buying a home is a major commitment, possibly the largest financial commitment of your life. That’s why you need to take a step back and ask yourself why you want to buy a home.

There’s no right answer to the question — some people buy a house as an investment, some buy to be close to family and friends, some buy because they want the independence and pride of ownership that comes with a place of one’s own.

All other things being equal (you can afford a home, you’re prepared to put in the time and effort to maintain it, you’ve found a builder and neighbourhood you’re comfortable with), the reason or reasons for buying a home are as individual as each of us.

Even so, before getting caught up in the excitement of shopping for a home, take the time to think about your reasons and discuss them with those you trust. Think about the longterm nature of the commitment you’re making. Investigate the differences — both pro and con — between owning versus renting.

Finally, ask yourself, “is this the best time to buy a house for me?” Is there a good selection of the type of home you want in the community you’re interested in?

Assess your housing needs and lifestyle

Buying a home can, and should, have an emotional component. Being a buyer and an owner is something that’s fun, rewarding and gives you a reason to strive for ever-better things in your career, your family life and your community. But your buying decision also has to be a rational one based on principles of smart investment like real-life needs, wants, limitations and potential.

To ensure your choices are rooted in reality, not fantasy, ask yourself these questions:

- When do you want to move into your new house and are you comfortable staying where you are in the interim? It’s not unusual for 12 to 18 months to elapse between signing an Agreement of Purchase and Sale and moving into a new home.

- What is your lifestyle now, and how do you picture it in five or ten years? Two bedrooms and two bathrooms may be ample at the moment, but that could get overly cosy if children come along or if you have a lot of long-term guests.

- Do you want a condo or a freehold home? Each has its own advantages, from the low maintenance aspects of a condo to the greater elbow room of most freehold homes. Learn more about purchasing a freehold home and a condominium.

- Do you want to buy new or resale? There are many advantages to buying a new home, from the quality of construction and reassurance of warranties to the chance to be part of a fresh, growing community.

- What sort of neighbourhood best suits you? A bustling downtown one with a vital nightlife and everything close at hand or a suburban community that entails some commuting but offers quiet, privacy, green space, new schools and the like?

- Have you thoroughly explored the new-home market to discover the range of homes and communities available when you’re buying a house in Ottawa? Websites like this one can save you hours of research by pooling information on housing developments, model homes and more in one spot.

- What other lifestyle choices matter to you? Do you want to stay within a strict budget when purchasing your home so that you have money left to travel? Do you have expensive hobbies like collecting art that could affect how much you want to spend on a home?

Creating your team

While you are the one who makes the final decision on which house to buy and where, you still need to work with professional services during the home buying journey.

Assess your housing needs and lifestyle

A mortgage specialist at a bank represents just that institution and its lending options. Interest rates and conditions for the same product can vary from lender to lender, so make sure you talk to several to get the mortgage that best suits your needs.

A mortgage broker approval and rate are usually valid within the time frame of 120 days to closing, so if you are purchasing a home and the closing date is more than 120 days away, you may have to re-qualify through this process (more than once) and your rate may be subject to change.

Whether you go with a bank or a mortgage broker, make sure you are comfortable with them and their products from the outset and that you take the time to fully understand your mortgage contract. Don’t hesitate to ask a lot of questions: it’s your money and your future wrapped up in that mortgage contract. Remember also to compare mortgage rates among institutions; Minto’s mortgage calculator can help with that.

Please note, the broker does not work directly for the lender, so the approval and rate are only valid for 120 days in most cases. If the closing date is longer than 120 days, you will have to re-qualify for approval.

On the other hand, for most traditional banks, it’s a one-time application process for pre-approval or firm approval. This means the rate is guaranteed without the need to re-qualify.

Mortgage pre-approval

A golden rule of home buying is to make sure you are pre-approved for a mortgage before you start shopping. It’s the only way you’ll know exactly how much money you have to spend. When you are arranging pre-approval, remember that it is not actually a guarantee that you will get the money. Make sure as well that all the terms and conditions you’ve negotiated are in your pre-approval agreement. Learn about mortgage pre-approval.

Legal counsel

Look for a real estate lawyer early in the buying process so you have someone available to review the Agreement of Purchase and Sale. Many buyers go with a personal recommendation from a friend or family member when choosing a lawyer.

Question the prospective lawyer on his or her expertise with this kind of transaction.

Four things to know about mortgages

- Use the internet to search for mortgage promotions and ads

- Discuss amortization periods (the length of time it will take to pay off your mortgage) with your mortgage professional. A shorter amortization means higher premiums but can save tens of thousands of dollars in interest payments.

- Many money professionals recommend not using the full amount of money a lender is willing to give you when buying a home. That way, you have a bit of wiggle room if unexpected expenses come along.

A lawyer who is familiar with the community and builder may also be helpful in alerting you to potential pitfalls, from plans for a noisy roadway in the area to a builder with a poor reputation.

Other legal tips:

- Discuss the importance of having a will with your lawyer and, if needed, a power of attorney. The more you own, the more important these protections become.

- If you are buying a home as an investment property, check our Ultimate Home Buyer’s Guide for Investors.

- Learn more about hiring a lawyer when buying a house.

Real estate agent

Buyers often ask, “Do I need a Realtor when buying a house?”

If you are considering the purchase of a resale home, a real estate agent is the way to go. A good Realtor will get to know your needs and wants, save you hours of research, make sound recommendations on money issues, and guide you through the purchase process.

However, if you are buying a new construction home, there is no real need to have a Realtor. The builder’s Sales Representatives know their products and communities inside out, and their job is to help you find the right home at the right price. Yes, they represent the builder, but they are trained to be objective and to put your needs and expectations first.

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Money Matters

Money Matters Minto Mortgage Payment Calculator

Minto Mortgage Payment Calculator Debt Service Calculator

Debt Service Calculator Choosing the right Mortgage

Choosing the right Mortgage